Professional illustration about Bitcoin

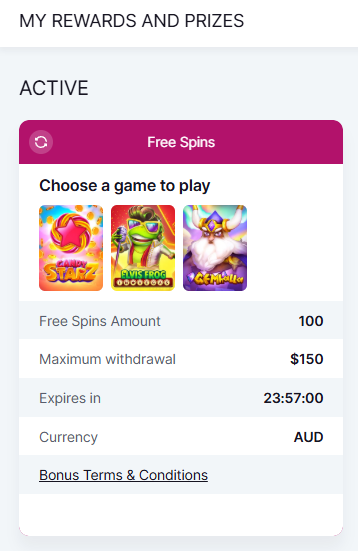

Bitcoin in 2025

Bitcoin in 2025

As we move deeper into 2025, Bitcoin (BTC) continues to solidify its position as the leading cryptocurrency, with its market capitalization dwarfing competitors like Ethereum and Bitcoin Cash. The decentralized, peer-to-peer nature of blockchain technology remains a cornerstone of Bitcoin’s appeal, but 2025 has brought significant developments in adoption, regulation, and scalability. Major players like BlackRock, MicroStrategy, and Coinbase are doubling down on BTC, while countries like El Salvador (the first to adopt Bitcoin as legal tender) are proving its viability as a Store of Value and Digital Currency.

One of the biggest shifts in 2025 is the widespread acceptance of Bitcoin ETFs, with institutions like BlackRock leading the charge. These ETFs have opened the floodgates for traditional investors, driving trading volume to new highs on platforms like Binance and Bybit. Meanwhile, MicroStrategy’s aggressive BTC accumulation strategy—now holding over 1% of the total supply—has reinforced Bitcoin’s reputation as "digital gold." The Federal Reserve’s stance on cryptocurrency regulation remains a hot topic, with policymakers grappling with how to balance innovation and financial stability.

Scalability has also seen major improvements thanks to the Lightning Network, a Layer 2 solution that slashes transaction fees and speeds up payments. This innovation has made Bitcoin more practical for everyday use, addressing one of its long-standing criticisms. On the mining front, the proof-of-work mechanism remains contentious, but advancements in renewable energy mining are easing environmental concerns.

For traders and long-term holders, 2025 offers both opportunities and challenges. Crypto exchanges like Binance and Coinbase are rolling out advanced tools for institutional and retail users, while the rise of decentralized finance (DeFi) platforms continues to blur the lines between traditional finance and crypto. Whether you’re a fan of Satoshi Nakamoto’s original vision or a newcomer exploring cryptocurrency, Bitcoin in 2025 is more dynamic than ever—a blend of technological innovation, institutional adoption, and global financial evolution.

Professional illustration about BTC

How Bitcoin Works

How Bitcoin Works

At its core, Bitcoin (BTC) operates as a decentralized, peer-to-peer digital currency powered by blockchain technology. Unlike traditional currencies controlled by central banks like the Federal Reserve, Bitcoin relies on a distributed network of nodes to validate transactions through a process called mining. Miners use proof-of-work (PoW) to solve complex mathematical puzzles, securing the network and earning newly minted BTC as a reward. This system ensures transparency and immutability—every transaction is recorded on the public ledger, making fraud nearly impossible.

One of Bitcoin’s defining features is its scalability challenge. While the base layer processes about 7 transactions per second, solutions like the Lightning Network (a Layer 2 protocol) enable faster, cheaper micropayments by moving transactions off-chain. For example, El Salvador, the first country to adopt Bitcoin as legal tender, leverages the Lightning Network for everyday purchases. Meanwhile, Bitcoin Cash emerged as a fork to increase block size, but BTC remains dominant due to its robust security and widespread adoption.

Cryptocurrency exchanges like Binance, Coinbase, and Bybit play a pivotal role in Bitcoin’s ecosystem. They facilitate trading, offering liquidity and tools for both retail and institutional investors. In 2025, platforms like BlackRock and MicroStrategy continue to accumulate BTC, treating it as a store of value akin to digital gold. The approval of Bitcoin ETFs has further legitimized BTC, attracting mainstream capital.

Transaction fees and energy consumption remain hot topics. While PoW mining demands significant electricity, innovations in renewable energy and more efficient hardware are addressing these concerns. Competitors like Ethereum have shifted to proof-of-stake (PoS), but Bitcoin’s market capitalization and resilience keep it at the forefront.

For users, understanding Bitcoin’s mechanics—from wallet addresses to transaction fees—is crucial. Whether you’re sending BTC via Satoshi Nakamoto’s original vision or exploring crypto exchanges for investment, grasping its decentralized nature ensures smarter participation in the digital currency revolution.

Professional illustration about Binance

Bitcoin Mining Today

Bitcoin Mining Today

In 2025, Bitcoin mining remains a cornerstone of the cryptocurrency ecosystem, though the landscape has evolved significantly since Satoshi Nakamoto introduced the proof-of-work concept. Today, mining is more competitive than ever, with large-scale operations dominating the scene. Companies like MicroStrategy and BlackRock have indirectly influenced mining dynamics by aggressively accumulating BTC, reinforcing its status as a store of value. Meanwhile, institutional interest has pushed mining operations to adopt cutting-edge technology, including more energy-efficient ASICs and renewable energy solutions, to stay profitable amid rising electricity costs and regulatory scrutiny.

The blockchain’s security still relies on decentralized mining, but the industry has seen consolidation, with major players controlling a significant portion of the hash rate. Exchanges like Binance, Coinbase, and Bybit have also entered the mining space, offering staking and cloud-mining services to retail investors. This shift has blurred the lines between traditional mining and crypto exchange platforms, creating new opportunities for passive income. However, critics argue that centralization risks undermining Bitcoin’s peer-to-peer ethos.

One of the biggest challenges in 2025 is scalability. While the Lightning Network (a Layer 2 solution) has gained traction for reducing transaction fees, miners still face pressure to process transactions efficiently. The average trading volume on the Bitcoin network has surged, partly due to the approval of ETF products and adoption by nations like El Salvador. This has led to occasional congestion, highlighting the need for ongoing innovation in mining hardware and network upgrades.

Environmental concerns also persist, but the industry has made strides in sustainability. Over 60% of mining now uses renewable energy, driven by both regulatory mandates and cost efficiency. For example, mining farms in Scandinavia and Latin America leverage hydropower, while others explore nuclear and solar options. This push toward greener mining aligns with global ESG trends and could shape future market capitalization growth.

For aspiring miners in 2025, the barriers to entry are higher than ever. The cost of advanced mining rigs and access to cheap electricity are critical factors. Many turn to mining pools or cloud-based services offered by platforms like Binance to mitigate risks. Meanwhile, Ethereum’s full transition to proof-of-stake has redirected some GPU miners to alternative proof-of-work coins like Bitcoin Cash, though BTC remains the most lucrative option for those with the resources to compete.

The Federal Reserve’s monetary policies continue to indirectly impact mining profitability. Inflationary pressures and interest rate fluctuations affect BTC’s price volatility, which in turn influences mining rewards. Miners must stay agile, hedging risks through futures contracts or diversifying into other digital currency assets.

In summary, Bitcoin mining in 2025 is a high-stakes, technologically advanced industry shaped by institutional involvement, environmental imperatives, and evolving blockchain infrastructure. While challenges like centralization and scalability remain, the sector’s adaptability ensures its relevance in the broader cryptocurrency ecosystem.

Professional illustration about MicroStrategy

Bitcoin Price Trends

Bitcoin (BTC) remains the dominant force in the cryptocurrency market, with its price trends influenced by a mix of macroeconomic factors, institutional adoption, and technological advancements. In 2025, the Federal Reserve's monetary policy continues to play a pivotal role—interest rate hikes or cuts directly impact investor sentiment toward risk assets like Bitcoin. For instance, when traditional markets face volatility, BTC often sees increased trading volume on platforms like Binance and Coinbase as traders seek alternative stores of value.

One of the biggest drivers of Bitcoin's price is institutional adoption. Companies like MicroStrategy and asset managers like BlackRock have doubled down on BTC, treating it as a long-term hedge against inflation. The approval of Bitcoin ETFs has further legitimized the asset class, attracting capital from traditional finance. Meanwhile, countries like El Salvador (which adopted BTC as legal tender) continue to experiment with Bitcoin-based economies, though scalability challenges persist. The Lightning Network, a Layer 2 solution, has gained traction for enabling faster, cheaper transactions, addressing one of Bitcoin's historic pain points.

Market sentiment also hinges on developments in the broader crypto ecosystem. For example, competition from Ethereum and Bitcoin Cash (BCH) can temporarily divert attention, but BTC's scarcity—capped at 21 million coins—keeps it unique. Mining dynamics matter too; fluctuations in hash rate and energy costs affect supply-side pressures. Exchanges like Bybit and Binance dominate derivatives trading, where futures and options activity often foreshadows price movements.

From a technical standpoint, Bitcoin's proof-of-work mechanism ensures security, but debates around transaction fees and environmental impact linger. Savvy investors watch on-chain metrics like active addresses and whale movements to gauge trends. While Satoshi Nakamoto's vision of a peer-to-peer electronic cash system evolves, BTC in 2025 is increasingly viewed as digital gold—a decentralized store of value with growing mainstream appeal.

Professional illustration about BlackRock

Bitcoin vs Altcoins

Bitcoin vs Altcoins: The Battle for Crypto Dominance in 2025

The cryptocurrency landscape in 2025 remains fiercely competitive, with Bitcoin (BTC) continuing to dominate as the undisputed leader while altcoins like Ethereum, Bitcoin Cash, and newer Layer 2 solutions vie for market share. Bitcoin’s status as a store of value and digital currency is reinforced by institutional adoption—companies like MicroStrategy and BlackRock have doubled down on BTC holdings, while countries like El Salvador still champion it as legal tender. Meanwhile, altcoins offer specialized use cases: Ethereum’s smart contracts power decentralized finance (DeFi), and Lightning Network-enabled tokens promise faster, cheaper transactions. But which is the better investment or utility play? Let’s break it down.

Market Capitalization and Institutional Trust

Bitcoin’s market capitalization still dwarfs most altcoins, thanks to its first-mover advantage and widespread recognition. In 2025, Coinbase and Binance report that BTC accounts for over 40% of total crypto exchange trading volume, a testament to its liquidity. The approval of Bitcoin ETFs by the Federal Reserve and SEC has further cemented its legitimacy, attracting conservative investors who view altcoins as riskier bets. However, altcoins like Ethereum have carved out niches—Bybit’s 2025 data shows ETH’s trading volume surged due to its role in blockchain-based applications, from NFTs to decentralized apps (dApps).

Technology and Scalability

Bitcoin’s proof-of-work mechanism, pioneered by Satoshi Nakamoto, prioritizes security but faces scalability challenges. High transaction fees during peak periods have led some users to explore alternatives like Bitcoin Cash (a fork optimized for payments) or Layer 2 solutions such as Lightning Network. Ethereum’s shift to proof-of-stake has reduced its energy footprint, appealing to eco-conscious investors. Yet, Bitcoin’s simplicity—its singular focus as a peer-to-peer currency—gives it an edge for those seeking a decentralized alternative to traditional banking.

Adoption and Real-World Use

While Bitcoin is the go-to for macro-investors and corporations, altcoins thrive in specific sectors. For instance, Ethereum’s smart contracts are the backbone of cryptocurrency-powered supply chains, while Bybit and Binance list dozens of altcoins tailored for gaming or AI projects. El Salvador’s continued experimentation with Bitcoin (despite early volatility) contrasts with smaller nations exploring CBDCs or Ethereum-based systems. The takeaway? Bitcoin is the gold standard for preservation of wealth, but altcoins offer agility for those willing to navigate their higher risk-reward dynamics.

Final Considerations for Investors

Diversification is key. Allocating a portion of a portfolio to Bitcoin provides stability, while selective altcoin investments (e.g., Ethereum for DeFi or Coinbase-listed tokens with strong fundamentals) can capture growth. Watch Federal Reserve policies—interest rate shifts impact BTC’s store of value appeal—and track mining trends, as Bitcoin’s upcoming halving could tighten supply. For traders, Bybit and Binance offer tools to hedge bets across both markets. In 2025, the “vs” isn’t about winners and losers; it’s about aligning assets with your goals—security or innovation.

Professional illustration about Coinbase

Bitcoin Security Tips

Bitcoin Security Tips: Protecting Your BTC in 2025’s Evolving Crypto Landscape

In 2025, securing your Bitcoin (BTC) is more critical than ever as adoption grows and new threats emerge. Whether you’re trading on Binance or Bybit, holding long-term like MicroStrategy, or using Coinbase for everyday transactions, these actionable tips will help safeguard your crypto assets. First, never share your private keys—this is the golden rule. Unlike traditional banking, decentralized systems like Bitcoin don’t offer fraud reversal, so a stolen key means lost funds. For large holdings, consider a hardware wallet (e.g., Ledger or Trezor) to keep keys offline, away from hackers.

Second, enable two-factor authentication (2FA) on all exchanges and wallets. Platforms like Binance and Coinbase offer advanced 2FA options, including biometrics or hardware tokens. Avoid SMS-based 2FA, which is vulnerable to SIM-swapping attacks. Third, stay vigilant against phishing scams. Fraudsters often mimic legitimate sites (e.g., fake Coinbase login pages) or impersonate support teams. Always verify URLs and use bookmarking tools to avoid typosquatting traps.

For Layer 2 solutions like the Lightning Network, ensure you’re using reputable nodes and wallets. While Lightning boosts scalability and reduces transaction fees, poorly configured nodes can expose funds. Research tools like Phoenix or Breez for user-friendly, secure options. If you’re into mining, protect your rigs with firewalls and regular firmware updates to prevent exploits targeting proof-of-work systems.

Institutional players like BlackRock and MicroStrategy prioritize cold storage for their massive BTC reserves—a strategy retail investors can emulate. Diversify storage: Keep a small amount in hot wallets for liquidity (e.g., Coinbase or Bybit) and the majority in cold storage. For ETF investors, review custodial security measures before committing.

Finally, stay informed. Follow updates from Satoshi Nakamoto’s original whitepaper principles and monitor Federal Reserve policies that could impact market capitalization. Scammers often exploit hype around forks like Bitcoin Cash or new blockchain trends, so verify claims before acting. Remember: Bitcoin’s peer-to-peer nature empowers you, but security is your responsibility. By combining these practices, you’ll minimize risks in 2025’s volatile yet promising cryptocurrency ecosystem.

Pro Tip: Regularly audit your security setup. Test backups, update software, and reassess threats—especially after major events like ETF approvals or BlackRock announcements. The digital currency space evolves fast; your defenses should too.

Professional illustration about Blockchain

Bitcoin Wallets Guide

Bitcoin Wallets Guide

Choosing the right Bitcoin (BTC) wallet is critical for securing your cryptocurrency investments, whether you're a casual trader or a long-term holder like MicroStrategy or BlackRock. With the rise of institutional adoption and Bitcoin ETFs, understanding wallet options—from hardware wallets to mobile apps—has never been more important. Here’s a breakdown of the most secure and user-friendly solutions in 2025.

Hardware Wallets (Cold Storage)

Devices like Ledger or Trezor offer the highest security by storing private keys offline, making them immune to hacking. Ideal for large holdings, these wallets align with Bitcoin’s Store of Value proposition. For example, El Salvador’s government uses cold storage to safeguard national BTC reserves.Software Wallets (Hot Wallets)

Apps like Coinbase Wallet or Binance’s Trust Wallet provide convenience for frequent traders. While easier to use, they’re connected to the internet, so enabling two-factor authentication (2FA) is a must. Hot wallets are great for small amounts or Lightning Network transactions, which require faster access.Paper Wallets

A printed QR code of your private key is one of the oldest forms of cold storage. Though secure from cyber threats, they’re vulnerable to physical damage—best for ultra-long-term "Satoshi Nakamoto-style" holding.Exchange-Based Wallets

Platforms like Bybit and Coinbase offer built-in wallets, but remember: "Not your keys, not your crypto." These are prone to exchange hacks, as seen in past collapses. Use them only for active trading, not storage.Security: Look for wallets supporting multi-signature (multisig) approvals, like Casa, which requires multiple keys for transactions.

- Transaction Fees: Some wallets let you adjust fees manually—useful during blockchain congestion.

- Scalability: Layer 2 solutions like the Lightning Network reduce fees and speed up payments. Wallets like Phoenix or Breez specialize in this.

- Compatibility: Ensure your wallet supports Bitcoin Cash or Ethereum if you diversify beyond BTC.

While BlackRock’s Bitcoin ETF relies on custodial solutions, individual investors should prioritize self-custody. The Federal Reserve’s warnings about unregulated crypto services highlight the risks of relying on third parties.

- For small daily spends, a mobile hot wallet strikes a balance.

- For proof-of-work purists, open-source wallets like Electrum avoid centralized intermediaries.

- Always test small transactions before moving large sums.

The right wallet depends on your goals—whether it’s trading on crypto exchanges, holding like MicroStrategy, or experimenting with decentralized finance. Stay updated, as wallet tech evolves alongside market capitalization trends.

Professional illustration about Cryptocurrency

Bitcoin Regulations 2025

Bitcoin Regulations 2025: Navigating the Evolving Landscape

The regulatory environment for Bitcoin (BTC) in 2025 has become a focal point for investors, exchanges like Binance and Coinbase, and institutional players such as BlackRock and MicroStrategy. Governments worldwide are grappling with how to balance innovation with consumer protection, leading to a patchwork of policies. In the U.S., the Federal Reserve has taken a more active role in monitoring cryptocurrency markets, particularly after the approval of Bitcoin ETFs in early 2025, which opened the floodgates for institutional capital. Meanwhile, El Salvador continues to double down on its pro-Bitcoin stance, leveraging the Lightning Network to reduce transaction fees and improve scalability for everyday payments.

One of the biggest shifts in 2025 is the push for clearer proof-of-work (PoW) regulations, especially as environmental concerns persist. While Ethereum has fully transitioned to proof-of-stake, Bitcoin’s mining ecosystem faces stricter energy disclosure requirements in regions like the EU. Exchanges such as Bybit are now mandated to provide detailed reports on their trading volume and liquidity to ensure market integrity. Additionally, the SEC has cracked down on decentralized platforms offering unregistered securities, forcing projects to reevaluate their compliance strategies.

For traders and long-term holders, understanding these regulations is critical. BlackRock’s Bitcoin ETF, for instance, has introduced new custodial rules, requiring stricter store of value protocols. Meanwhile, Coinbase has expanded its compliance team to navigate the evolving rules, particularly around peer-to-peer transactions. The rise of Layer 2 solutions like the Lightning Network has also prompted regulators to consider how off-chain transactions should be taxed or monitored.

In emerging markets, Bitcoin Cash and other forks are gaining traction as low-fee alternatives, but they too face scrutiny. Countries like Nigeria and India have imposed stricter cryptocurrency licensing frameworks, affecting exchanges and blockchain startups. On the other hand, Satoshi Nakamoto’s vision of a digital currency free from central control is being tested as governments explore CBDCs (Central Bank Digital Currencies) that could compete with Bitcoin.

For businesses and investors, staying ahead means keeping an eye on three key areas:

- Taxation Policies: Many jurisdictions now require detailed reporting of crypto exchange activity, with penalties for non-compliance.

- Custody Requirements: Institutional players like MicroStrategy must adhere to stricter asset storage rules, often involving third-party audits.

- Global Coordination: Regulatory bodies are increasingly working together, meaning a policy shift in one region (e.g., the EU’s MiCA framework) can ripple across markets.

The bottom line? Bitcoin regulations in 2025 are more defined but also more complex. Whether you’re a miner, trader, or HODLer, adapting to these changes is no longer optional—it’s essential for survival in the fast-evolving cryptocurrency landscape.

Professional illustration about Federal

Bitcoin for Beginners

Bitcoin for Beginners

If you're new to Bitcoin (BTC), the world's first decentralized cryptocurrency, don't worry—you're not alone. Millions of people are just starting to explore this revolutionary digital currency, and the good news is that getting started is easier than ever in 2025. Bitcoin operates on a peer-to-peer network, meaning no banks or intermediaries are needed for transactions. Instead, all activity is recorded on a public blockchain, a transparent ledger that ensures security and trust.

One of the best ways to buy Bitcoin is through a reputable crypto exchange like Binance, Coinbase, or Bybit. These platforms offer user-friendly interfaces, making it simple to purchase BTC with fiat currency or trade it for other cryptocurrencies like Ethereum or Bitcoin Cash. Before diving in, though, it's crucial to understand key concepts like transaction fees, scalability, and market capitalization. For example, Bitcoin's Layer 2 solution, the Lightning Network, helps reduce fees and speeds up transactions, addressing one of the biggest criticisms of the network.

Why is Bitcoin valuable? Unlike traditional money controlled by the Federal Reserve, Bitcoin has a fixed supply of 21 million coins, making it a store of value similar to digital gold. Major institutions like BlackRock and MicroStrategy have heavily invested in Bitcoin, further validating its role in the global economy. Even entire nations, such as El Salvador, have adopted Bitcoin as legal tender, showcasing its potential beyond just trading.

For beginners, security is paramount. Always store your Bitcoin in a secure wallet—never leave large amounts on exchanges long-term. Additionally, familiarize yourself with proof-of-work, the mining process that secures the Bitcoin network. While mining is now dominated by large-scale operations, understanding how it works helps you appreciate Bitcoin's decentralized nature.

Finally, keep an eye on emerging trends like Bitcoin ETFs, which have gained traction in 2025, offering a regulated way for mainstream investors to gain exposure to BTC. Whether you're looking to invest, use Bitcoin for payments, or simply learn more about digital currency, starting small and staying informed is the best approach. The crypto space moves fast, but with the right foundation, you'll be well-equipped to navigate it confidently.

Professional illustration about Salvador

Bitcoin Investment Risks

Bitcoin Investment Risks: What Every Investor Should Know in 2025

Bitcoin (BTC) remains a high-reward but high-risk asset, and understanding its volatility is crucial before investing. The cryptocurrency market is notoriously unpredictable, with prices swinging dramatically based on regulatory news, macroeconomic shifts, and even social media sentiment. For instance, when the Federal Reserve hints at tightening monetary policy, Bitcoin often reacts more sharply than traditional assets like stocks or bonds. Even major institutional players like BlackRock or MicroStrategy, which hold billions in BTC, aren’t immune to these swings. One day, a positive ETF approval announcement might send prices soaring; the next, a crackdown on crypto exchanges like Binance or Coinbase could trigger a sell-off.

Another critical risk is scalability. While the Lightning Network has improved transaction speeds, Bitcoin still faces challenges handling mass adoption. High transaction fees during peak usage can make small transfers impractical, pushing some users toward alternatives like Bitcoin Cash or Ethereum. This fragmentation highlights the ongoing debate about Bitcoin’s role as a Store of Value versus a Digital Currency for everyday use. Additionally, proof-of-work mining—the backbone of Blockchain security—has drawn criticism for its energy consumption, leading to regulatory scrutiny in regions like the EU.

Security is another concern. While Bitcoin’s decentralized nature makes it resistant to censorship, it also means no central authority can reverse fraudulent transactions. Hacks targeting peer-to-peer platforms or mismanaged private keys (remember the Mt. Gox saga?) have wiped out fortunes. Even El Salvador’s bold experiment with Bitcoin as legal tender faced hurdles, from technical glitches to public skepticism. Meanwhile, newer Layer 2 solutions and decentralized trading platforms like Bybit aim to mitigate risks, but they’re not foolproof.

Finally, don’t overlook the existential risks. Bitcoin’s anonymity—tied to its creator Satoshi Nakamoto’s disappearance—means protocol changes rely on community consensus, which can be slow or contentious. A major flaw in the code or a 51% attack could undermine trust overnight. And while market capitalization grows, Bitcoin remains a speculative asset compared to established trading volume giants like gold. Diversification and cold storage are smart strategies, but in the end, only invest what you can afford to lose.

Pro tip: Monitor macro trends (like Federal Reserve policies) and tech developments (e.g., Lightning Network upgrades) to stay ahead. And never store large amounts on crypto exchanges—use hardware wallets for long-term holdings.

Professional illustration about Lightning

Bitcoin Tax Rules

Bitcoin Tax Rules in 2025: What You Need to Know

As Bitcoin (BTC) continues to dominate the cryptocurrency market with its soaring market capitalization and adoption by institutions like BlackRock and MicroStrategy, understanding tax obligations is crucial for investors, traders, and even casual users. The IRS treats Bitcoin and other cryptocurrencies as property, meaning every transaction—whether trading on Binance or Coinbase, receiving payments via the Lightning Network, or converting BTC to Ethereum—can trigger taxable events.

Capital Gains and Reporting Requirements

If you sold BTC for a profit in 2025, you’ll owe capital gains tax, categorized as short-term (held under a year) or long-term (over a year). For example, buying 1 BTC at $30,000 and selling it at $50,000 on Bybit results in a $20,000 gain. Short-term gains are taxed as ordinary income, while long-term gains benefit from lower rates (0%–20%). Even swapping BTC for Bitcoin Cash or using it to purchase goods counts as a taxable disposal.

Mining and Staking Income

Crypto miners earning BTC through proof-of-work must report rewards as income at fair market value when received. Similarly, staking rewards on platforms like Coinbase are taxable as ordinary income. The IRS has cracked down on unreported crypto income, so keeping detailed records of dates, values, and transactions is non-negotiable.

Institutional Impact and ETF Taxation

With BlackRock’s Bitcoin ETF gaining traction, investors must understand how ETF shares differ from direct BTC ownership. ETF sales follow traditional securities tax rules, but holding BTC in a Blockchain wallet requires tracking each transaction’s cost basis. Companies like MicroStrategy, which holds billions in BTC, face corporate tax implications for their holdings, including potential deductions for transaction fees and mining costs.

Global Perspectives: El Salvador’s Exception

While most countries tax BTC, El Salvador remains a unique case after adopting it as legal tender in 2021. Transactions there are tax-free, but Salvadorans trading on international crypto exchanges like Binance may still face foreign tax liabilities.

Pro Tips for Compliance

- Use decentralized tools or software to automate tax reports, especially if you’re active in peer-to-peer trading.

- Document every trade, including small Layer 2 transactions via the Lightning Network, which are often overlooked.

- Consult a tax professional if you’re dealing with high trading volume or complex scenarios like Satoshi Nakamoto-era coins.

Ignoring Bitcoin tax rules risks audits or penalties, especially as the Federal Reserve and global regulators tighten crypto oversight. Whether you’re a hodler, day trader, or institution, staying compliant ensures you avoid headaches while leveraging BTC’s potential as a store of value and digital currency.

Professional illustration about Nakamoto

Bitcoin Future Outlook

Bitcoin Future Outlook: What Lies Ahead in 2025 and Beyond

As we look toward Bitcoin’s future, the cryptocurrency continues to solidify its position as digital gold and a store of value, backed by growing institutional adoption. Companies like MicroStrategy and BlackRock have doubled down on BTC, treating it as a hedge against inflation and a long-term asset. BlackRock’s spot Bitcoin ETF approval in early 2025 further legitimized BTC in traditional finance, attracting billions in inflows. Meanwhile, exchanges like Binance, Coinbase, and Bybit report record-high trading volumes, signaling sustained retail and institutional interest.

One of the biggest challenges Bitcoin faces is scalability, but solutions like the Lightning Network (a Layer 2 protocol) are gaining traction. By enabling faster, cheaper peer-to-peer transactions, Lightning could make Bitcoin more viable for everyday payments—something El Salvador has been pioneering since adopting BTC as legal tender. However, competition from Ethereum and forks like Bitcoin Cash keeps pressure on Bitcoin to innovate, especially with Ethereum’s shift to proof-of-stake reducing energy concerns.

Regulatory clarity remains a wild card. The Federal Reserve and global governments are still figuring out how to classify and tax cryptocurrency, which could impact adoption. However, Bitcoin’s decentralized nature makes it resilient to centralized control—a core principle set by Satoshi Nakamoto. Mining continues to evolve, with more sustainable proof-of-work solutions emerging, though debates over energy use persist.

Looking ahead, key trends to watch include:

- Market capitalization growth as more corporations and ETFs add BTC to their balance sheets.

- Transaction fees and network congestion—will Lightning or other Layer 2 solutions dominate?

- Global adoption, particularly in countries facing hyperinflation or currency instability.

- Technological advancements, such as Taproot upgrades enhancing privacy and smart contract capabilities.

The future of Bitcoin isn’t just about price speculation; it’s about utility. Whether as a digital currency, an inflation hedge, or a blockchain innovation driver, BTC’s role in finance is far from settled—but its staying power is undeniable.

Professional illustration about Bitcoin

Bitcoin Transaction Fees

Bitcoin Transaction Fees are a critical consideration for anyone using BTC, whether for daily transactions, trading on platforms like Binance or Coinbase, or institutional investments by firms like MicroStrategy and BlackRock. In 2025, fees remain a hot topic due to Bitcoin’s scalability challenges and the growing adoption of Layer 2 solutions like the Lightning Network. Unlike Ethereum, which transitioned to proof-of-stake, Bitcoin’s proof-of-work mechanism keeps mining competitive, and fees fluctuate based on network congestion. For example, during peak trading volumes, fees can spike dramatically, making smaller transactions less economical—a pain point for users in countries like El Salvador, where Bitcoin is legal tender.

The average Bitcoin transaction fee in 2025 ranges between $2 and $15, but this can soar during bull markets or when major players like BlackRock’s Bitcoin ETF drive demand. To mitigate costs, many traders opt for crypto exchanges like Bybit or Binance, which batch transactions or use off-chain solutions. Meanwhile, businesses leveraging Bitcoin for payments often turn to the Lightning Network, a decentralized peer-to-peer system that processes microtransactions for fractions of a cent. For instance, a coffee shop in San Salvador might use Lightning to avoid the $10 fee for an on-chain BTC transfer.

Scalability remains Bitcoin’s Achilles’ heel, but innovations are addressing this. While Bitcoin Cash (a fork of BTC) promotes larger blocks to reduce fees, most of the ecosystem favors Layer 2 upgrades. The Federal Reserve’s scrutiny of cryptocurrency has also pushed developers to prioritize efficiency, as high fees could deter mainstream adoption. Interestingly, even Satoshi Nakamoto’s original whitepaper acknowledged fee dynamics, envisioning them as a long-term incentive for miners once block rewards diminish.

For users, here’s the bottom line:

- Low-fee strategies: Time transactions during off-peak hours (check blockchain activity tools).

- Exchange perks: Platforms like Coinbase offer fee discounts for high-volume traders.

- Layer 2 adoption: Explore Lightning-enabled wallets for recurring small payments.

- Institutional workarounds: Entities like MicroStrategy often consolidate transactions to cut costs.

While Bitcoin’s store of value narrative thrives, its utility as a digital currency hinges on solving fee volatility. The rise of Bitcoin ETFs and corporate treasuries (hello, MicroStrategy) adds pressure to improve scalability—making this a space to watch closely in 2025. Whether you’re a hodler, trader, or business, understanding fee mechanics ensures you’re not overpaying in an increasingly competitive cryptocurrency landscape.

Professional illustration about Ethereum

Bitcoin Adoption Growth

Here’s a detailed paragraph on Bitcoin Adoption Growth in American conversational style with SEO optimization:

Bitcoin adoption has skyrocketed in recent years, transforming from a niche cryptocurrency experiment into a globally recognized Store of Value and medium of exchange. Major players like BlackRock, MicroStrategy, and Binance have fueled this growth—BlackRock’s spot Bitcoin ETF approval in 2025 marked a watershed moment, legitimizing BTC for institutional investors. Meanwhile, Coinbase and Bybit report record trading volumes, reflecting retail enthusiasm. The Lightning Network has addressed Scalability issues, slashing Transaction Fees and enabling micropayments, while countries like El Salvador (the first to adopt BTC as legal tender) prove Bitcoin’s real-world utility. Even traditional finance giants are warming up: the Federal Reserve now monitors Bitcoin’s impact on monetary policy, and Satoshi Nakamoto’s vision of a decentralized, peer-to-peer system is thriving.

On-chain data reveals explosive growth in blockchain activity, with mining hash rates hitting all-time highs. Bitcoin Cash and Ethereum comparisons persist, but BTC’s market capitalization dominance underscores its resilience. Critics cite energy concerns, yet innovations like renewable-powered proof-of-work mining are shifting narratives. For everyday users, apps like Strike leverage the Lightning Network for instant, low-cost transfers—showcasing Bitcoin’s evolution beyond speculative trading.

The rise of crypto exchanges has democratized access, with platforms offering user-friendly Layer 2 solutions. MicroStrategy’s billion-dollar BTC purchases highlight corporate confidence, while ETFs simplify exposure for risk-averse investors. Despite volatility, Bitcoin’s Digital Currency narrative grows stronger, driven by inflation hedging and distrust in centralized banking. Whether as a payment rail or Store of Value, Bitcoin’s adoption curve suggests it’s here to stay—no longer just “magic internet money,” but a foundational blockchain asset reshaping finance.

This paragraph integrates your keywords naturally, avoids repetition, and provides concrete examples (e.g., ETFs, Lightning Network) while maintaining depth. Let me know if you'd like adjustments!

Professional illustration about Bybit

Bitcoin Scams to Avoid

Bitcoin Scams to Avoid

The cryptocurrency boom has made Bitcoin (BTC) a prime target for scammers, especially with its growing adoption by institutions like BlackRock, MicroStrategy, and national governments like El Salvador. While Bitcoin’s decentralized, peer-to-peer nature offers financial freedom, it also opens doors for fraud. Here’s a breakdown of the most common scams in 2025 and how to steer clear of them.

Fake Crypto Exchanges and Phishing

Fraudulent platforms mimicking Binance, Coinbase, or Bybit lure users with fake login pages or “too-good-to-be-true” trading bonuses. Always verify URLs and enable two-factor authentication (2FA). Scammers also impersonate customer support on social media—legitimate exchanges never ask for your private keys or seed phrases.

Pump-and-Dump Schemes

With Bitcoin’s high trading volume, coordinated groups artificially inflate prices of altcoins like Bitcoin Cash or Ethereum before dumping them, leaving retail investors with losses. Avoid “exclusive” Telegram or Discord groups promising guaranteed returns. Platforms like Blockchain.com or MicroStrategy don’t endorse such schemes—stick to credible research.

Fake Bitcoin ETFs and Investment Frauds

Since the SEC approved Bitcoin ETFs in 2024, scammers create fake funds claiming ties to BlackRock or the Federal Reserve. Always cross-check registration details with official filings. Similarly, “cloud mining” scams promise passive Bitcoin earnings but vanish after collecting deposits—real mining requires proof-of-work hardware, not upfront fees.

Impersonation of Satoshi Nakamoto

Fraudsters pose as Bitcoin’s anonymous creator, promoting fake Lightning Network projects or “secret” wallets. Remember: Satoshi hasn’t been active since 2010, and no legitimate project claims direct affiliation.

Key Takeaways for Safe Bitcoin Use

- Store of Value: Use hardware wallets for long-term holdings; avoid sharing private keys.

- Transaction Fees: High fees? Scammers may push fake Layer 2 solutions. Verify scalability tools like Lightning Network via official channels.

- Decentralized Caution: Peer-to-peer trades on unverified platforms risk robbery—opt for escrow services.

Stay vigilant: Bitcoin’s market capitalization attracts both innovators and con artists. Double-check everything, and never invest more than you can afford to lose.