Professional illustration about American

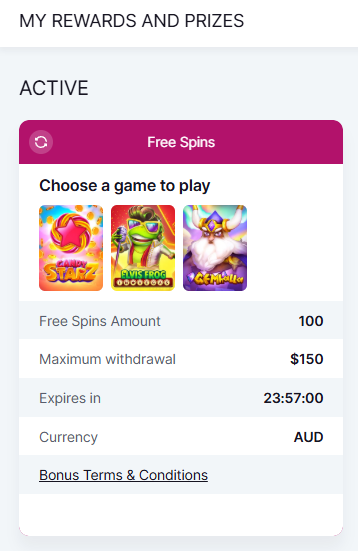

Gold Coin Basics

Gold coins have long been a cornerstone of precious metals investing, offering a tangible way to own gold bullion while enjoying the aesthetic appeal of finely crafted designs. Whether you're a seasoned investor or a newcomer to the world of gold investment, understanding the basics of these coins is essential. Among the most popular options are the Gold American Eagle and Gold American Buffalo, both minted by the U.S. government and highly sought after for their purity and liquidity. The American Eagle features Lady Liberty on the obverse and a family of eagles on the reverse, while the American Buffalo showcases a Native American chief and the iconic buffalo design, paying homage to classic U.S. coinage.

For those looking beyond U.S. mints, the Canadian Gold Maple Leaf is renowned for its .9999 purity, making it one of the purest bullion coins available. Its intricate maple leaf design and advanced security features, like radial lines and micro-engraving, set it apart. Meanwhile, the South African Gold Krugerrand holds historical significance as the first modern gold bullion coin, introduced in 1967 to promote private gold ownership. Its distinctive orange-gold hue comes from a small copper alloy, enhancing durability for handling.

Diversifying your portfolio with international coins like the Chinese Gold Panda or Mexican Gold Libertad can add unique value. The Gold Panda is celebrated for its annually changing panda design, while the Libertad features Mexico’s iconic Winged Victory statue. Other notable options include the Somalian Gold Elephant, British Gold Britannia, Australian Gold Kangaroo, and Austrian Gold Philharmonic, each with distinct cultural and artistic elements.

When evaluating gold coins, consider factors like gold coin purity, gold coin weights, and gold coin premiums. Most bullion coins are minted in 1 oz, ½ oz, ¼ oz, and 1/10 oz fractional weights, allowing investors to buy smaller denominations at lower price points. However, smaller coins often carry higher premiums over the gold spot price due to production costs. Additionally, gold coin mintage numbers can influence rarity and long-term value—limited editions or low-mintage years may command higher premiums in the secondary market.

Another critical aspect is understanding the face value of gold coins. While coins like the Gold American Eagle have a legal tender value (e.g., $50 for a 1 oz coin), their actual worth is tied to the current gold spot price, which fluctuates daily. This makes them different from numismatic coins, where collectibility drives value more than metal content. For investors looking to include gold in a gold IRA, only certain government-minted bullion coins are eligible, so verifying IRS-approved options is crucial.

Finally, storage and authentication play a role in maintaining value. Reputable dealers provide certificates of authenticity, and third-party grading services can verify a coin’s condition. Whether you’re stacking gold bullion bars or collecting coins for their artistic merit, knowing these fundamentals ensures smarter decisions in the dynamic world of precious metals.

Professional illustration about American

Investing in Gold Coins

Investing in gold coins is one of the most reliable ways to diversify your portfolio with precious metals, offering both tangible value and historical stability. In 2025, popular choices like the Gold American Eagle, American Buffalo, and Canadian Gold Maple Leaf continue to dominate the market due to their recognized purity, liquidity, and government backing. These bullion coins are minted with high gold purity (typically .9999 fine gold for the Gold Maple Leaf and .9167 for the Gold American Eagle), making them ideal for investors seeking both intrinsic and collectible value.

One key advantage of gold investment through coins is their fractional weights, allowing flexibility for buyers with varying budgets. For example, the Gold American Eagle is available in 1 oz, 1/2 oz, 1/4 oz, and 1/10 oz sizes, while the Chinese Gold Panda and Austrian Gold Philharmonic also offer smaller denominations. This makes it easier to enter the market without committing to larger gold bullion bars. Additionally, coins like the South African Gold Krugerrand and Mexican Gold Libertad often carry lower gold coin premiums over the gold spot price compared to rare numismatic coins, making them cost-effective for pure investment purposes.

When selecting gold coins, consider factors like mintage numbers and design variations, which can influence long-term value. Limited-edition releases, such as certain years of the British Gold Britannia or Australian Gold Kangaroo, may appreciate beyond their metal content due to collector demand. Meanwhile, the Somalian Gold Elephant series is known for its unique annual design changes, appealing to both investors and hobbyists. For those looking to include gold in a retirement strategy, Gold IRA-eligible coins like the Gold American Buffalo (with its .9999 purity) are a smart choice, as they meet IRS standards for precious metals IRAs.

Storage and liquidity are also critical considerations. Government-minted coins like the Gold American Eagle or Gold Krugerrand are widely recognized, ensuring easier resale compared to obscure or private mint offerings. Always verify authenticity by purchasing from reputable dealers and checking for proper gold coin face values, mint marks, and security features. In 2025, as global economic uncertainties persist, gold bullion coins remain a hedge against inflation and currency fluctuations, combining historical prestige with modern investment practicality.

For newcomers, starting with widely traded coins—such as the Gold Maple Leaf or Gold American Eagle—is advisable, as their market liquidity reduces selling hurdles. Advanced investors might explore semi-numismatic options like the Chinese Gold Panda, which blends bullion value with artistic appeal. Regardless of your strategy, staying informed about gold coin designs, fractional weights, and global mint trends will help maximize returns in this timeless asset class.

Professional illustration about American

Rare Gold Coin Values

Rare gold coin values are driven by a mix of factors, including rarity, condition, historical significance, and current gold spot prices. Collectors and investors alike prize coins like the Gold American Eagle, American Buffalo, and Canadian Gold Maple Leaf not just for their bullion value but for their numismatic appeal. For instance, early-year Gold Krugerrands or limited-mintage Chinese Gold Pandas can fetch premiums far above their gold content due to collector demand. The Mexican Gold Libertad and Somalian Gold Elephant series are particularly sought after for their unique designs and low production numbers, making them standout pieces in any portfolio.

When evaluating rare gold coins, consider these key aspects:

- Mintage numbers: Coins with lower production runs, like certain years of the British Gold Britannia or Australian Gold Kangaroo, often command higher values.

- Condition (grading): A pristine Gold American Eagle graded MS-70 will vastly outperform a circulated one in value.

- Design variations: The Austrian Gold Philharmonic has seen design tweaks over the years, and earlier versions can be more valuable.

- Market trends: While gold bullion prices fluctuate daily, rare coins often move independently based on collector trends.

For investors, rare gold coins offer dual benefits: they’re tangible assets tied to gold investment fundamentals while also serving as collectibles with appreciating potential. Coins like the Gold American Buffalo (with its .9999 purity) or the Gold Maple Leaf (known for its advanced security features) blend modern minting technology with intrinsic value. Meanwhile, vintage Gold Krugerrands or Gold Libertads appeal to history buffs and those betting on long-term scarcity.

Pro tip: Pay attention to gold coin premiums—the markup over spot price. Rare coins typically carry higher premiums, but they can also outperform generic gold bullion bars in resale scenarios. For example, a 1986 Gold American Eagle (first year of issue) might trade at a 50%+ premium, while a recent-year coin may hover near 10%. Always cross-reference with auction results and dealer networks to gauge true market value.

Lastly, don’t overlook gold coin fractional weights. Smaller denominations (e.g., 1/10 oz or 1/4 oz) of rare series like the Gold Britannia or Gold Panda can be more liquid and accessible, yet still benefit from the same numismatic upside. Whether you’re building a gold IRA or a personal collection, rare coins add diversification and storytelling appeal that plain bullion can’t match.

Professional illustration about American

Gold Coin Authentication

Gold Coin Authentication: How to Verify the Real Deal in 2025

Authenticating gold coins is a critical step for investors and collectors alike, especially when dealing with popular bullion coins like the Gold American Eagle, American Buffalo, or Canadian Gold Maple Leaf. With counterfeiters becoming increasingly sophisticated, knowing how to spot genuine precious metals can save you from costly mistakes. Here’s a breakdown of the key methods to ensure your gold coins are legitimate.

1. Weight and Dimensions Check

Every reputable gold bullion coin has precise specifications. For example, a 1-ounce Gold American Eagle should weigh 33.93 grams (1.09 troy ounces) due to its 22-karat composition, while a 1-ounce American Buffalo (24-karat) weighs exactly 31.103 grams. Use a calibrated digital scale and calipers to verify these metrics. Even a slight deviation could indicate a fake. Fractional weights, like 1/10 or 1/4-ounce coins, must also match their stated values.

2. Magnet Test and Density Verification

Gold is non-magnetic, so if a coin sticks to a magnet, it’s a red flag. However, some counterfeits use non-magnetic metals like tungsten, which has a similar density to gold. To rule this out, try the water displacement test: calculate the coin’s density by dividing its weight by its volume. Pure gold should have a density of 19.32 g/cm³. For coins like the South African Gold Krugerrand or Chinese Gold Panda, this test is especially useful since their alloys are standardized.

3. Edge Inspection and Design Details

Authentic gold coins have sharp, consistent edges with reeding or lettering that’s clean and uniform. For instance, the Mexican Gold Libertad features a unique edge pattern, while the British Gold Britannia has milled edges. Counterfeits often have blurred or uneven edges. Additionally, examine the coin’s design under magnification. Genuine coins have intricate, high-quality engravings—look for fine details like the maple leaves on the Gold Maple Leaf or the kangaroo on the Australian Gold Kangaroo.

4. Sound Test (Ping Test)

Gold produces a distinct, high-pitched ring when struck. Lightly tap the coin with another gold piece or a metal object—if it sounds dull or thuds, it might be a fake. This works well for coins like the Austrian Gold Philharmonic or Somalian Gold Elephant, which have specific acoustic signatures due to their alloys.

5. Professional Authentication and Certification

For high-value coins or rare mintages, consider third-party authentication from organizations like PCGS or NGC. They use advanced tools like X-ray fluorescence (XRF) to verify purity and authenticity. This is particularly important for coins intended for a gold IRA, where purity standards are strict.

6. Mint Marks and Packaging

Legitimate bullion coins come with proper mint marks and often include certificates of authenticity. For example, the Gold American Eagle will have the "W" (West Point) mint mark, while the Canadian Gold Maple Leaf features the Royal Canadian Mint’s logo. Original packaging, like assay cards or tamper-evident capsules, adds another layer of verification.

7. Spot Price and Premiums

If a deal seems too good to be true, it probably is. Compare the seller’s price to the current gold spot price and typical gold coin premiums. For instance, a 2025 Gold Krugerrand should command a modest premium over spot—if it’s being sold far below market value, proceed with caution.

By combining these methods, you can confidently authenticate gold coins and protect your gold investment. Whether you’re handling a Gold American Buffalo or a Chinese Gold Panda, attention to detail is your best defense against counterfeits in today’s market.

Professional illustration about Canadian

Best Gold Coin Dealers

When it comes to buying gold bullion coins, choosing the right dealer is just as important as selecting the right coins for your investment portfolio. The best gold coin dealers in 2025 offer a combination of competitive pricing, authenticity guarantees, and exceptional customer service. Whether you're looking for Gold American Eagle coins, Canadian Gold Maple Leafs, or South African Gold Krugerrands, reputable dealers ensure you get the purest form of precious metals at fair gold spot price premiums.

One of the top considerations when evaluating dealers is their inventory diversity. Leading providers stock a wide range of bullion coins, including popular options like the American Buffalo, Chinese Gold Panda, and Mexican Gold Libertad, as well as niche favorites like the Somalian Gold Elephant or Austrian Gold Philharmonic. Dealers with extensive selections allow investors to diversify their holdings across different gold coin designs, weights, and mints. For example, some investors prefer fractional weights (like 1/10 oz or 1/4 oz coins) for flexibility, while others focus on gold coin purity (such as the .9999 fine Gold Maple Leaf).

Transparency in pricing is another critical factor. The best dealers clearly display gold coin premiums above the spot price, avoiding hidden fees. In 2025, expect premiums to vary depending on gold coin mintage rarity and demand—for instance, British Gold Britannia or Australian Gold Kangaroo coins might carry slightly higher premiums due to their intricate designs and limited annual releases. Reputable dealers also provide real-time gold spot price updates, ensuring buyers make informed decisions.

Authenticity and security should never be compromised. Trusted dealers often partner with mints directly or are authorized distributors, reducing the risk of counterfeit coins. Look for dealers offering tamper-evident packaging and certificates of authenticity, especially for high-value coins like the Gold American Eagle or Gold Krugerrand. Some dealers even provide buyback programs, adding liquidity to your gold investment.

For those considering a gold IRA, selecting an IRS-approved dealer is non-negotiable. These specialists understand the strict requirements for gold bullion bars and coins eligible for retirement accounts. They’ll guide you through IRS-approved options, such as certain Gold American Buffalo or American Eagle coins, while ensuring compliance with storage and reporting rules.

Finally, customer service can make or break your experience. The best dealers offer educational resources, whether you're a first-time buyer or a seasoned collector. They’ll explain nuances like gold coin face value (which is often symbolic, as the metal value far exceeds it) or the pros and cons of different bullion coins. Look for dealers with responsive support teams and clear return policies—because when it comes to precious metals, trust is everything.

To sum up, the ideal gold coin dealer in 2025 combines a robust inventory, fair pricing, ironclad security, and stellar service. Whether you're building a diversified portfolio or securing a gold IRA, partnering with the right dealer ensures your investment in gold bullion coins is both profitable and peace-of-mind guaranteed.

Professional illustration about Maple

Gold Coin Storage Tips

Gold Coin Storage Tips

Proper storage is crucial for protecting your gold coins, whether you own Gold American Eagles, American Buffalos, or Canadian Gold Maple Leafs. These coins aren’t just valuable for their gold bullion content—their condition directly impacts their gold coin premiums and resale potential. Here’s how to store them safely:

Use Airtight Containers: Exposure to air can tarnish coins over time. For high-value pieces like South African Gold Krugerrands or Chinese Gold Pandas, consider acrylic capsules or inert Mylar flips to prevent oxidation. Avoid PVC-based holders, as they can damage the surface.

Control Humidity and Temperature: Store coins in a cool, dry place (ideally below 70°F and 60% humidity). A fireproof safe with silica gel packs works well for Austrian Gold Philharmonics or British Gold Britannias. Extreme heat or moisture can degrade coin designs or cause spotting.

Segregate by Type and Purity: Mixing coins like Mexican Gold Libertads (999 purity) with lower-purity Gold Krugerrands (9167) risks scratches. Use individual tubes or padded trays, especially for fractional weights (e.g., 1/10 oz coins).

Insurance and Documentation: Even if your gold IRA or personal collection includes bullion coins with low face value, their gold spot price makes them theft targets. Keep an inventory with photos, serial numbers (for proofs), and purchase receipts.

Discretion Matters: Avoid broadcasting your holdings. If storing Australian Gold Kangaroos or Somalian Gold Elephants at home, use a diversion safe or a bank safety deposit box. For larger collections, professional vaults with audit trails are worth considering.

Regular Inspections: Check stored coins annually for signs of corrosion or holder degradation. Even Gold American Eagles in mint packaging can develop milk spots if exposed to humidity fluctuations.

Pro Tip: For gold coin mintage rarities (like limited-edition Gold Maple Leafs), archival-quality storage is non-negotiable. The right precautions preserve both precious metals value and numismatic appeal.

Professional illustration about Krugerrand

Gold Coin Collecting Guide

Here’s a detailed, SEO-optimized paragraph on Gold Coin Collecting Guide in American conversational style:

Gold coin collecting is a fascinating blend of history, artistry, and smart investing. Whether you're drawn to the iconic Gold American Eagle or the intricate designs of the Chinese Gold Panda, each coin tells a story. Start by focusing on bullion coins—government-minted options like the American Buffalo, Canadian Gold Maple Leaf, or South African Gold Krugerrand—which are prized for their purity (typically .9999 fine gold) and liquidity. For collectors who appreciate variety, limited-edition coins like the Mexican Gold Libertad or Somalian Gold Elephant offer unique designs that often appreciate in value beyond their gold spot price.

When building your collection, consider fractional weights (1/10 oz, 1/4 oz, etc.) for flexibility, especially if you're new to precious metals. The Austrian Gold Philharmonic and British Gold Britannia, for example, come in multiple sizes, making them accessible for different budgets. Pay attention to mintage numbers—lower production years (like certain Australian Gold Kangaroo editions) can command higher premiums over time. Storage matters too: opt for airtight capsules or professional vaults to preserve condition, which is critical for resale value.

For those eyeing gold IRAs, stick to IRS-approved coins like the Gold American Eagle or Gold Krugerrand, which meet purity and legal tender requirements. Don’t overlook design evolution either; the Gold Panda changes its panda motif annually, adding collectible appeal. Finally, track gold coin premiums (the markup over melt value) and buy during market dips to maximize your investment. Whether you’re in it for passion or profit, a well-curated collection balances rarity, liquidity, and that timeless golden glow.

Pro tip: Mix modern bullion with vintage pieces (pre-1933 U.S. gold coins) for a diversified portfolio that hedges against economic shifts. Always verify authenticity through reputable dealers—counterfeits plague the gold bullion market, especially for high-demand coins like the Gold Buffalo. Happy hunting!

Professional illustration about Krugerrand

Gold Coin Market Trends

The gold coin market trends in 2025 reflect a dynamic landscape driven by investor demand, geopolitical factors, and evolving designs from global mints. Gold American Eagle and American Buffalo coins remain top performers in the U.S., with their .9167 purity (22-karat) and iconic designs appealing to both collectors and investors. The Canadian Gold Maple Leaf, known for its .9999 purity, continues to dominate the bullion market due to its advanced security features, like radial lines and micro-engraved maple leaf markers. Meanwhile, the South African Gold Krugerrand maintains its historical significance as the first modern gold bullion coin, often traded at lower premiums due to its high mintage.

One notable trend is the rising popularity of fractional-weight coins, particularly among younger investors seeking affordable entry points into gold investment. For example, the Chinese Gold Panda and Mexican Gold Libertad now offer 1/20 oz and 1/10 oz options, catering to this demand. The British Gold Britannia has also gained traction with its annual design updates and .9999 purity, while the Australian Gold Kangaroo stands out for its unique yearly kangaroo motif. On the other hand, the Austrian Gold Philharmonic leverages its cultural appeal and Euro-denominated face value to attract European buyers.

Here’s what’s shaping the market in 2025:

- Gold spot price volatility: Fluctuations in the gold spot price have led to increased trading activity, with investors leveraging dips to acquire gold bullion coins at lower premiums.

- Design innovations: Mints are incorporating advanced anti-counterfeiting measures, such as the Gold Maple Leaf’s laser-marked security features, boosting consumer confidence.

- Gold IRA growth: More investors are diversifying retirement portfolios with gold IRA-eligible coins like the American Eagle and American Buffalo, taking advantage of tax benefits.

- Regional demand shifts: Asian markets are driving demand for the Chinese Gold Panda, while North America favors the Gold American Eagle and Canadian Gold Maple Leaf.

Premiums vary significantly across coins, with limited-edition releases like the Somalian Gold Elephant commanding higher prices due to low mintage. Collectors should also monitor gold coin purity and weights—for instance, the Gold Krugerrand is 22-karat but contains a full ounce of gold, while the Gold Libertad is struck in .999 fine gold. Whether you’re a long-term investor or a collector, staying informed about gold coin market trends ensures smarter decisions in this ever-evolving space.

Professional illustration about Chinese

Gold Coin vs Bullion

When deciding between gold coins and gold bullion for your precious metals portfolio, it’s essential to understand their key differences in terms of design, liquidity, and investment flexibility. Gold coins, such as the Gold American Eagle, American Buffalo, or Canadian Gold Maple Leaf, are government-minted and often carry a face value, making them legal tender. These coins are highly recognizable, which enhances their resale value, and they often feature intricate designs like the iconic South African Gold Krugerrand or the annually updated Chinese Gold Panda. Their fractional weights (e.g., 1/10 oz, 1/4 oz) make them accessible to smaller investors, though they typically carry higher premiums over the gold spot price compared to bullion bars.

On the other hand, gold bullion refers to bars or rounds, usually produced by private mints, that prioritize purity and weight over aesthetics. Bullion is ideal for investors focused solely on gold investment due to its lower premiums and higher gold coin purity (often .9999 fine gold). For example, a 1-oz gold bar will generally cost less per ounce than a 1-oz Gold American Eagle, which has a slightly lower purity (.9167) but includes added durability and collectible appeal. Bullion is also available in larger sizes (e.g., 10 oz, 1 kg), making it a cost-effective choice for those looking to maximize their metal holdings. However, bullion lacks the face value and recognizability of coins, which can impact liquidity in certain markets.

One critical factor to consider is gold coin mintage. Limited-edition coins like the Mexican Gold Libertad or Somalian Gold Elephant can appreciate beyond their metal content due to collector demand, while bullion’s value is tied strictly to weight and purity. Additionally, certain coins, such as the British Gold Britannia or Australian Gold Kangaroo, feature advanced security features (e.g., micro-engraving), reducing counterfeit risks—a perk bullion bars don’t typically offer. For gold IRA purposes, the IRS approves specific coins like the Austrian Gold Philharmonic and Gold American Buffalo, but most bullion bars must meet stringent fineness and manufacturer criteria to qualify.

Here’s a practical breakdown for investors:

- Coins shine for liquidity, divisibility, and potential numismatic upside. They’re easier to sell in small quantities and often command higher demand in retail markets.

- Bullion excels for pure gold investment with minimal premiums, especially for large-volume buyers. It’s a straightforward way to track the gold spot price without worrying about design variations or collector trends.

Ultimately, your choice depends on goals. If you prioritize flexibility and aesthetic appeal, gold bullion coins like the Gold Krugerrand or Gold Maple Leaf are stellar options. For cost-efficient metal accumulation, bullion bars are unbeatable. Many savvy investors diversify with both, balancing the liquidity of coins with the bulk-value advantage of bullion.

Professional illustration about Libertad

Historic Gold Coins

Historic gold coins hold a unique place in the world of gold investment, blending numismatic charm with the intrinsic value of precious metals. These coins aren’t just gold bullion; they’re pieces of history, often minted by governments and featuring iconic designs that reflect their cultural heritage. For collectors and investors alike, understanding the legacy of these coins can add depth to your gold IRA or physical holdings.

Take the Gold American Eagle, for example. First issued in 1986 by the U.S. Mint, it’s one of the most recognizable bullion coins globally, with its iconic Lady Liberty design and guaranteed gold purity of 91.67% (22-karat). Its sibling, the Gold American Buffalo, debuted in 2006 as the first 24-karat gold coin from the U.S. Mint, featuring James Earle Fraser’s classic Buffalo Nickel design. Both coins are backed by the U.S. government, making them a staple in gold coin portfolios.

Across the border, the Canadian Gold Maple Leaf stands out for its 99.99% purity and intricate maple leaf motif. Since its 1979 introduction, it’s been a favorite for investors seeking gold coin fractional weights, available in sizes as small as 1/20 oz. Meanwhile, the South African Gold Krugerrand, first minted in 1967, revolutionized the gold bullion coins market by being the first modern coin intended for private investment. Its durable 22-karat composition and Paul Kruger’s portrait make it a historic cornerstone.

Asia’s Chinese Gold Panda is another standout, with its annually changing panda design and .999 purity. The Panda’s limited gold coin mintage adds collectible appeal, while the Mexican Gold Libertad, minted by the Banco de México, showcases the Winged Victory statue and is prized for its high gold coin purity (99.9% since 1991).

Europe’s contributions include the British Gold Britannia, which debuted in 1987 with a stunning depiction of Britannia and a shield, and the Austrian Gold Philharmonic, celebrating Vienna’s musical legacy with .9999 fine gold. For wildlife enthusiasts, the Somalian Gold Elephant series offers exotic appeal, while the Australian Gold Kangaroo (first issued in 1986) combines .9999 purity with annually updated kangaroo designs.

When evaluating historic gold coins, consider factors like gold coin premiums, gold spot price trends, and gold coin face value (though the metal content usually far exceeds nominal values). Older issues or low-mintage years often carry higher premiums due to rarity. For example, early Gold Krugerrands or first-year American Eagles can command significant collector premiums.

Whether you’re drawn to the artistry of the Gold Libertad or the timeless appeal of the Gold Britannia, historic coins offer a tangible connection to the past while serving as a hedge in today’s volatile markets. Their enduring designs and government backing make them a smart choice for diversifying with gold bullion bars or coins. Just remember: storage and insurance are key to preserving their value for generations.

Professional illustration about Somalian

Gold Coin Grading

Gold coin grading is a critical aspect of determining the value and authenticity of your precious metals, whether you're holding a Gold American Eagle, Canadian Gold Maple Leaf, or a rare Chinese Gold Panda. Professional grading assesses a coin's condition based on factors like wear, luster, strike quality, and surface preservation. For instance, a MS-70 (Mint State Perfect) grade indicates a flawless Gold Krugerrand with no visible imperfections under 5x magnification—a key factor for collectors paying premium prices. Meanwhile, circulated coins like older American Buffalo pieces might grade AU-50 (About Uncirculated), showing minor wear on high points but retaining most original detail.

The gold bullion market heavily relies on grading standards from third-party services like PCGS or NGC, which authenticate and encapsulate coins in tamper-proof holders. Coins like the Mexican Gold Libertad or British Gold Britannia often see price jumps of 10-30% when professionally graded, especially in higher tiers (MS-65 and above). Even small imperfections—hairline scratches on an Australian Gold Kangaroo or toning on an Austrian Gold Philharmonic—can significantly impact resale value. For investors, understanding grading helps avoid overpaying for raw coins marketed as "pristine" when they’re actually VF (Very Fine).

Here’s a pro tip: Focus on eye appeal—a subjective but crucial grading factor. A Somalian Gold Elephant with vibrant luster might outshine a technically higher-graded coin with dull surfaces. Also, consider mintage rarity; a lower-grade Gold American Eagle from a scarce year could be worth more than a common MS-69. Always cross-reference grading reports with current gold spot prices and coin premiums to gauge true market value. For gold IRAs, stick to NGC- or PCGS-graded coins to ensure compliance with purity standards (e.g., .9999 for Gold Maple Leafs).

Lastly, storage matters. Even MS-70 coins can degrade if exposed to humidity or handled improperly. Use inert materials like Mylar flips for raw coins, and avoid cleaning—a single wipe can turn a potential MS-65 Gold Buffalo into a details-only grade. Whether you’re buying or selling, grading knowledge turns speculation into savvy gold investment decisions.

Professional illustration about Britannia

Gold Coin Tax Rules

Gold Coin Tax Rules: What Investors Need to Know in 2025

Understanding the tax implications of buying, selling, or holding gold coins is crucial for investors looking to maximize returns while staying compliant. In the U.S., the IRS classifies Gold American Eagle, American Buffalo, and other bullion coins as collectibles, which means they’re subject to a maximum capital gains tax rate of 28%—higher than the standard long-term rate for stocks or ETFs. Short-term gains (held under one year) are taxed as ordinary income, which can climb to 37% depending on your tax bracket.

Key Tax Considerations for Popular Gold Coins

- Gold American Eagle & Buffalo: These U.S.-minted coins have a face value but are valued based on their gold content. The IRS treats them like other precious metals, so profits from sales are taxed as capital gains.

- Canadian Gold Maple Leaf and South African Gold Krugerrand: Foreign-minted coins are also considered collectibles, but their gold purity (e.g., 99.99% for Maple Leafs) can influence premiums and resale value, indirectly affecting taxable gains.

- Gold IRAs: Holding coins like the Austrian Gold Philharmonic or Chinese Gold Panda in a self-directed IRA defers taxes until withdrawal, but distributions are taxed as ordinary income. Early withdrawals before age 59½ may trigger a 10% penalty.

Strategies to Minimize Tax Liability

1. Hold Long-Term: Aim for the 28% long-term rate by holding coins like the British Gold Britannia or Australian Gold Kangaroo for over a year.

2. Offset Gains with Losses: Sell underperforming assets (e.g., gold bullion bars) to balance profits from coin sales.

3. Gift or Inherit: Transferred coins receive a stepped-up basis, reducing capital gains for heirs. For example, gifting a Mexican Gold Libertad to family resets its cost basis upon inheritance.

State Taxes and Reporting

Some states, like California, impose additional taxes on gold bullion coins, while others (e.g., Texas) exempt them from sales tax. Always document transactions—sales of Somalian Gold Elephant or similar coins exceeding $10,000 may require IRS Form 1099-B reporting.

Practical Example

If you bought a Gold American Eagle in 2025 at $2,500 and sold it later for $3,200, your $700 profit would face a 28% federal tax (plus state taxes if applicable). Compare this to gold ETFs, which are taxed at 15–20% for long-term gains, highlighting the trade-off between physical ownership and tax efficiency.

Final Notes

- Gold coin premiums and mintage rarity (e.g., limited-edition Gold Britannia designs) don’t affect tax rates but can increase resale value.

- Consult a tax professional to navigate complex scenarios, like mixing fractional-weight coins in a portfolio or leveraging gold IRAs for retirement planning. Staying informed ensures your gold investment aligns with both financial goals and legal obligations.

Professional illustration about Australian

Gold Coin IRA Options

Gold Coin IRA Options: Diversifying with Precious Metals

In 2025, investors looking to hedge against inflation or diversify their retirement portfolios are increasingly turning to Gold Coin IRAs. These self-directed Individual Retirement Accounts allow you to hold physical gold bullion coins as part of your retirement savings, offering a tangible asset that isn’t tied to the volatility of traditional stocks and bonds. The IRS has strict guidelines on which coins qualify for a Gold IRA, so it’s crucial to choose IRS-approved gold coins that meet purity standards (typically .995 fine or higher). Among the most popular options are the Gold American Eagle and Gold American Buffalo, both minted by the U.S. government with a face value and backed by their gold content. The American Eagle, for instance, contains 1 oz of 22-karat gold, while the American Buffalo boasts 24-karat purity, making them highly liquid and recognizable worldwide.

For those seeking international diversification, coins like the Canadian Gold Maple Leaf and South African Gold Krugerrand are excellent choices. The Gold Maple Leaf is renowned for its .9999 purity and advanced security features, while the Gold Krugerrand—one of the first modern bullion coins—carries historical significance and strong liquidity. Other global options include the Chinese Gold Panda, which updates its design annually, and the Mexican Gold Libertad, a favorite among collectors for its stunning imagery. The British Gold Britannia and Australian Gold Kangaroo are also IRA-eligible, offering .9999 purity and government backing. Meanwhile, the Austrian Gold Philharmonic stands out for its musical theme and consistent demand in European markets.

When selecting gold bullion coins for your IRA, consider factors like gold coin premiums (the cost above the gold spot price), mintage (lower mintage often means higher collectibility), and fractional weights (e.g., 1/2 oz, 1/4 oz coins for more flexible investments). For example, smaller denominations like the Somalian Gold Elephant or fractional Gold American Eagles can be easier to liquidate if you need to sell portions of your holdings. It’s also wise to work with a reputable custodian who specializes in precious metals IRAs, as they’ll handle storage (usually in IRS-approved depositories) and ensure compliance with tax regulations.

One often-overlooked aspect of gold investment is the balance between gold coin designs and practicality. While some investors prioritize aesthetics (like the intricate details on the Gold Libertad), others focus purely on gold content and liquidity. Remember, the primary goal of a Gold IRA is wealth preservation, so avoid overpaying for rare or collectible coins unless you’re blending numismatic and bullion strategies. Lastly, keep an eye on the gold coin face value—though it’s typically symbolic (e.g., $50 for a 1 oz Gold American Eagle), it’s a key feature that distinguishes IRA-eligible coins from generic gold bullion bars. By carefully selecting the right mix of coins, you can build a resilient retirement portfolio that stands the test of time.

Professional illustration about Philharmonic

Gold Coin Scams Alert

Gold Coin Scams Alert: How to Spot and Avoid Fraud in 2025

The gold coin market is booming in 2025, with investors flocking to Gold American Eagle, American Buffalo, and other bullion coins as a hedge against inflation. However, this surge in demand has also led to a rise in sophisticated scams targeting both novice and experienced buyers. Whether you're eyeing a Canadian Gold Maple Leaf or a South African Gold Krugerrand, understanding how to identify fraudulent schemes is critical to protecting your gold investment.

Common Gold Coin Scams to Watch Out For

Counterfeit Coins: High-quality fakes of popular coins like the Chinese Gold Panda or Mexican Gold Libertad are flooding the market. Scammers use advanced techniques to mimic weights, designs, and even gold coin purity marks. Always verify coins with a reputable dealer or use a precious metals testing kit.

Misrepresented Grades: Some sellers claim their Gold Krugerrand or Australian Gold Kangaroo coins are in "mint condition" when they’re actually circulated or damaged. Request high-resolution photos and consider third-party grading services like PCGS or NGC.

Pump-and-Dump Schemes: Fraudsters artificially inflate the gold spot price of lesser-known coins (e.g., Somalian Gold Elephant) through fake reviews or social media hype, then disappear after buyers overpay. Stick to established gold bullion coins with transparent market pricing.

Fake Dealers: Unlicensed online sellers offering "too-good-to-be-true" discounts on British Gold Britannia or Austrian Gold Philharmonic coins often vanish after payment. Always check dealer credentials on the Better Business Bureau or the U.S. Mint’s authorized retailer list.

Gold IRA Scams: Fraudulent companies push overpriced or ineligible coins for gold IRAs, claiming tax advantages. Only IRS-approved coins like the Gold American Eagle or certain Gold Maple Leaf varieties qualify.

Red Flags and Prevention Tips

- Unrealistic Prices: If a seller offers a Gold Buffalo or Gold Libertad far below the gold spot price, it’s likely a scam. Compare prices across trusted platforms like APMEX or JM Bullion.

- Poor Packaging: Authentic gold bullion coins come in protective cases with certificates. Loose coins or blurry documentation are warning signs.

- Pressure Tactics: Scammers often use urgency ("limited supply!") to rush buyers. Take time to research gold coin mintage and premiums before purchasing.

- No Return Policy: Reputable dealers allow returns. Avoid sellers with strict "no refunds" policies, especially for high-value coins like the Gold American Eagle.

What to Do If You’re Scammed

If you suspect fraud (e.g., receiving a fake Canadian Gold Maple Leaf), report it to the FTC and your state’s consumer protection agency. For counterfeit coins, contact the issuing mint (e.g., the Royal Canadian Mint for Gold Maple Leaf issues). Document all communications and transactions for evidence.

By staying vigilant and sticking to trusted sources, you can safely invest in gold coins without falling prey to 2025’s evolving scams. Always prioritize dealers with decades-long reputations and transparent gold coin premiums.

Professional illustration about Bullion

Gold Coin Cleaning Methods

Cleaning gold coins is a topic that divides collectors and investors—some swear by gentle maintenance, while others argue that any cleaning diminishes a coin’s value. If you own Gold American Eagles, American Buffalos, or other bullion coins like the Canadian Gold Maple Leaf or South African Gold Krugerrand, understanding proper cleaning methods is crucial to preserving their gold coin purity and long-term gold investment appeal.

First Rule: Less Is More

The numismatic community overwhelmingly agrees: never aggressively clean gold bullion coins. Scrubbing with abrasive materials or harsh chemicals can strip away delicate finishes, scratch surfaces, and even reduce the gold coin weight accuracy. For example, the Chinese Gold Panda’s intricate design or the Mexican Gold Libertad’s high-relief details can be permanently damaged by improper cleaning. Instead, use a soft microfiber cloth to gently remove fingerprints or dust. For stubborn dirt, distilled water (never tap water, which contains minerals) and a mild, phosphate-free soap are safer options.

Special Considerations for Proof Coins

If you own proof versions of British Gold Britannias or Australian Gold Kangaroos, extra caution is needed. These coins have mirrored finishes that show flaws easily. A single wipe with a rough cloth can create hairline scratches, significantly lowering their gold coin premiums. For proof coins, experts recommend using a handheld air blower (like those for camera lenses) to dislodge dust particles without physical contact.

When Cleaning Might Be Necessary

While most precious metals experts advise against cleaning, there are exceptions. Circulated Austrian Gold Philharmonics or Somalian Gold Elephants with heavy tarnish might benefit from a professional conservation service. These specialists use ultrasonic cleaners or acetone baths (for PVC residue) under controlled conditions. However, DIY methods like baking soda or vinegar should never be used—they can corrode the gold coin face value layer or alter the metal’s luster.

Storage Matters More Than Cleaning

Preventative care is the best strategy. Store your gold IRA-eligible coins in inert Mylar flips or airtight capsules to minimize exposure to humidity and pollutants. For bulk storage of gold bullion bars or fractional gold coin weights, silica gel packets inside a fireproof safe can help control moisture. Remember: even natural skin oils can accelerate toning, so handle coins by the edges while wearing cotton gloves.

The Verdict on DIY vs. Professional Care

Unless your Gold American Eagle or Gold Maple Leaf has adhesive residues (e.g., from old stickers), avoid cleaning altogether. The gold spot price is based on metal content, but collectors pay premiums for original surfaces. If in doubt, consult a reputable grading service like PCGS or NGC—they offer conservation services that won’t void gold coin mintage authenticity. For everyday maintenance, a simple dry microfiber wipe is the safest bet.

By following these guidelines, you’ll protect the aesthetic and monetary value of your gold coins, whether they’re American Buffalos for a gold IRA or rare Canadian Gold Maple Leafs for a collection. The key takeaway? When it comes to cleaning, restraint is your best tool.